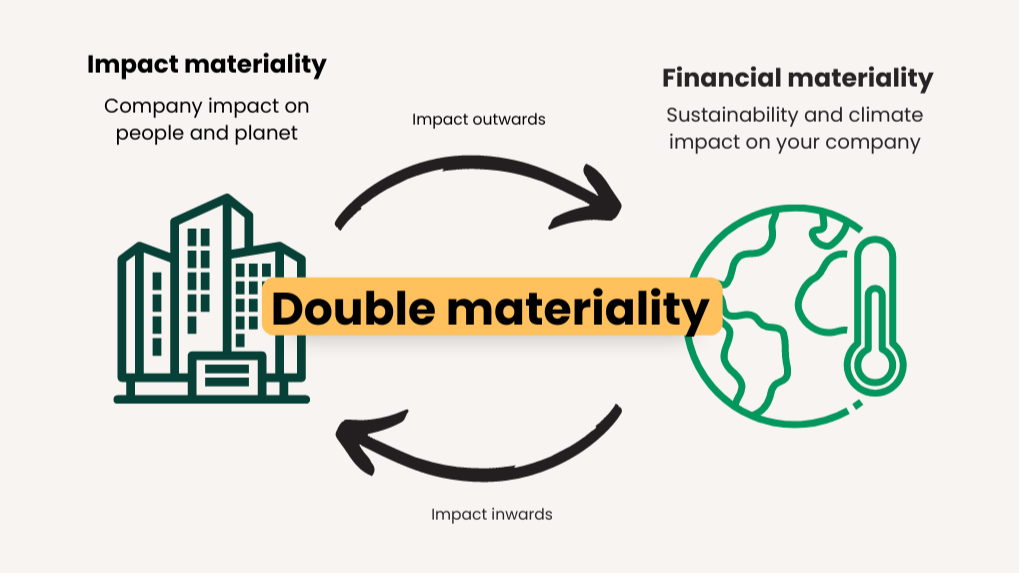

As businesses face increasing pressure to integrate sustainability into their operations, the concept of Double Materiality has emerged as a critical framework. With the implementation of the Corporate Sustainability Reporting Directive (CSRD) in the European Union, companies are now required to conduct a Double Materiality Assessment (DMA), which takes into account both their impact on the world and the impact of external sustainability factors on their business.

What is Double Materiality?

Double Materiality requires companies to evaluate their sustainability efforts from two perspectives,

- Impact Materiality (Inside Out Perspective) – This aspect assesses how a company’s operations affect the environment and society. For example, the carbon emissions generated by a business, its water consumption, or labor practices must be examined to understand the broader social and environmental consequences.

- Financial Materiality (Outside In Perspective) – This dimension focuses on how external environmental, social, and governance (ESG) factors influence a company’s financial performance. Changing regulations on climate issues, evolving consumer preferences, or the risks of resource scarcity can significantly affect the company’s bottom line.

By integrating these two perspectives, Double Materiality ensures a more comprehensive understanding of a company’s sustainability position, highlighting both risks and opportunities for long term value creation.

Key Components of a Double Materiality Assessment

To comply with CSRD requirements and implement an effective DMA, businesses must consider the following components:

- Data Collection – Companies need to gather accurate and transparent data on their internal operations and external ESG factors. This data must be auditable and reliable, forming the basis for the assessment.

- Materiality Analysis – Determining which ESG factors are most material from both impact and financial perspectives is essential. This analysis helps businesses prioritize their sustainability efforts and align them with business goals.

- Strategy Alignment – A key element of DMA is ensuring that a company’s sustainability strategy is aligned with its material impacts. This involves addressing both how the company influences the environment and society and how ESG factors impact the company’s financial success.

- Reporting Standards – Adhering to the European Sustainability Reporting Standards (ESRS), which outline how to conduct and disclose the results of a DMA, is crucial for compliance and transparency.

DMA forms the backbone of CSRD compliance, helping companies navigate the complexities of sustainability reporting while positioning themselves to manage risks and seize opportunities in a sustainability-driven market.

Why Double Materiality Matters

CSRD marks a significant shift in how companies are expected to approach non financial reporting. Starting from year 2024, businesses must provide detailed disclosures on their environmental and social impact, as well as how external ESG factors affect their financial standing. This transition emphasizes the importance of treating non financial data with the same rigor as financial information.

Double Materiality helps companies identify and manage risks that arise from sustainability challenges while enabling them to align their sustainability strategies with long term value creation. This approach benefits both shareholders and stakeholders, contributing to a more sustainable business model.

Double Materiality is more than just a regulatory requirement, it’s a strategic tool for building sustainable businesses that create long term value. By embracing this comprehensive framework, companies can better navigate the evolving landscape of sustainability reporting and strengthen their position in a sustainability driven economy.